Despite a significant decline in the global smartphone market, the decline in India and Southeast Asia's 3 major emerging markets is not significant and exhibit different characteristics, especially in the high-end market, where demand may increase in the second half of 2023, boosting market confidence.

In the second quarter of 2023, the global smartphone market revenue fell by 8% year-on-year and 15% quarter-on-quarter, well below $90 billion, the lowest figure for the second quarter since the worst period of the global epidemic-related blockade in 2020. According to Counterpoint's data, Q2 global smartphone operating profit fell below US$13 billion, down 3% year-on-year and 27% quarter-on-quarter. While the global mobile phone market has experienced a sharp decline, India and emerging markets in Southeast Asia, especially the Indian market, are unique. This article will briefly analyze the three key markets in Southeast Asia: India, Indonesia, and the Philippines.

01

"Made in India" mobile phones cumulatively surpassed 2 billion units

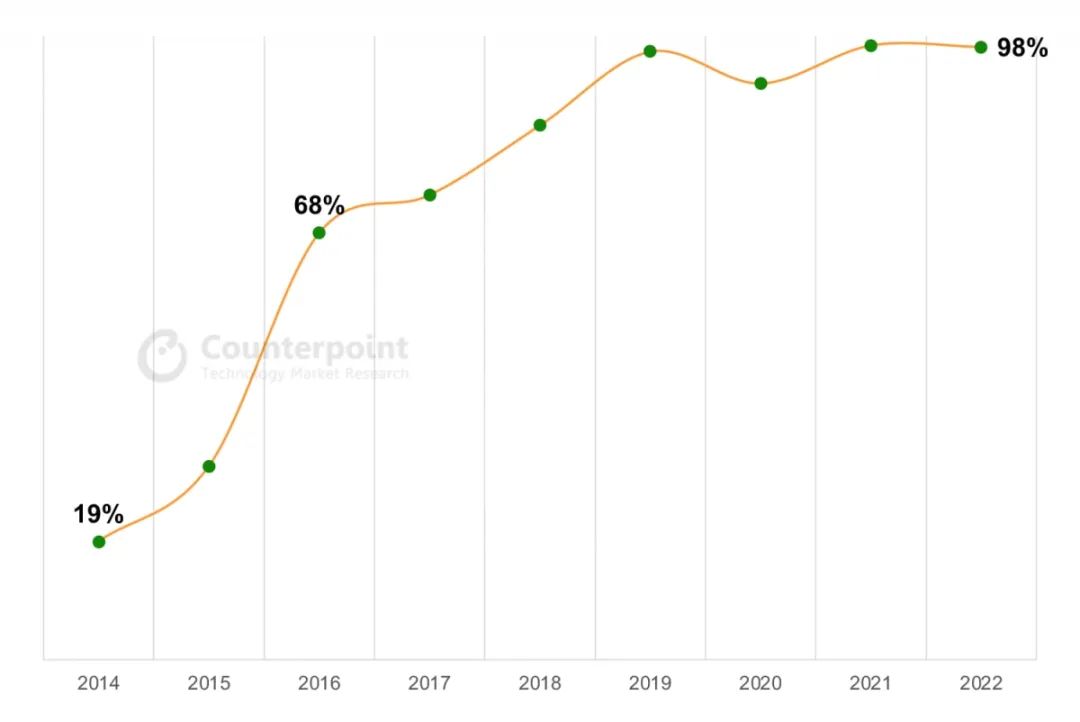

According to Counterpoint's data, from 2014 to 2022, under the "Make in India" plan, the cumulative shipments of "Made in India" mobile phones exceeded the 2 billion mark, with a compound annual growth rate of 23%. Huge internal demand, rising digital economy, and government push are the main reasons for this growth. India has thus become the second largest mobile phone producer. The Indian government has introduced schemes and initiatives such as Phased Manufacturing Program (PMP), Make in India, Production Linked Incentive (PLI) and Atma-Nirbhar Bharat to increase local manufacturing and value addition.

Research Director Tarun Pathak said: "India has come a long way in mobile phone manufacturing. Over the years, we have seen local manufacturing grow to meet domestic demand. The overall Indian market will account for more than 98% of shipments by 2022 It is "Made in India".

It was only 19% in 2014 when the current government took office. At the same time, local value added and supply chain development in India is increasing. Local value added in India now averages over 15%, compared to single digits eight years ago. Many companies are setting up factories in India to produce mobile phones and components, leading to increased investment, job creation and overall ecosystem development. The Indian government now intends to use its various programs to make India a "semiconductor manufacturing and export hub". Going forward, the market is likely to see increased production, especially of smartphones, as India strives to bridge the urban-rural digital divide and become a major exporter of mobile phones.

Source: Counterpoint

On the move by the Indian government, senior analyst Prachi Singh said, "The government has launched and executed many schemes which have resulted in a huge jump in the mobile phone manufacturing industry over the years. Under the 'Make in India' initiative, the government has introduced a phased manufacturing scheme , and has raised import duties on complete vehicles and some key components over the years to promote local manufacturing and value addition. Under India's Self-Reliance Plan, the government has launched a Production Linked Incentive (PLI) scheme for 14 industries, including mobile phone manufacturing. As a result, India’s exports have increased. Going forward, the government’s focus is to make India a hub. It came up with a semiconductor PLI plan and now it’s more focused on infrastructure with $1.4 trillion to invest.”

02

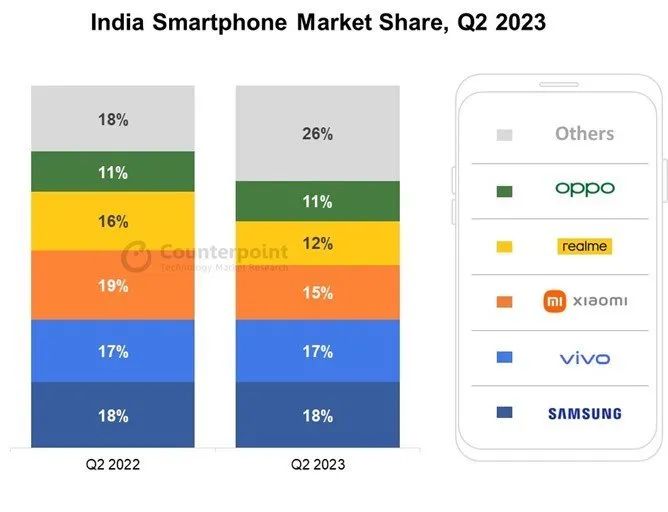

However, the high-end smartphone market showed a different picture, growing 112% year-over-year in the second quarter and accounting for a record high 17% of overall shipments.

Commenting on the market dynamics, Senior Research Analyst Shilpi Jain said, "In Q2 2023, OEMs see improved inventory and demand conditions ahead of the upcoming festive season. Active measures were taken to clear existing inventory through multiple sales and promotions. On the consumer side, lower inflation and improved growth prospects contributed to the recovery in demand. 5G upgrades also played a major role, with OEMs continuing to trade between INR 10,000 to INR 15,000 (~$122-$244) segment launched 5G devices to expand coverage. We believe that brands will attract consumers with interesting products and offers during the festive season, and 5G will be a big growth driver here. "

Source: Counterpoint

Samsung maintained its lead for the third consecutive quarter with an 18% market share, but Apple continued to lead the ultra-premium segment (>INR 45,000 or ~$549) with a 59% share. India has now become Apple's fifth largest market.

To sum up, the characteristics of the Q2 Indian smartphone market are as follows:

- 5G smartphone growth: Cumulative 5G smartphone shipments in India will cross the 100 million mark in Q2 2023, as 5G network expansion and affordable device adoption accelerate the pace of 5G upgrades. 5G smartphone shipments grew 59% year-over-year in the quarter.

- Premiumization trend: The premiumization trend is gaining momentum as the segment grows at a faster rate of 112% year-over-year. The rise of value-based incentive systems for retailers, aggressive promotions, credit through various financing schemes, and a centralized approach by OEMs are driving premiumization in India.

- Channel dynamics: The share of offline channels has been growing and is expected to rise to 54% in 2023. Online-heavy brands such as Xiaomi, realme, and OnePlus are now emphasizing offline expansion to improve customer engagement and ecosystem development. Samsung and Apple are also increasing their offline businesses to cater to different consumer preferences. This shift reflects a more holistic approach, using both online and offline channels to create a seamless and personalized customer experience.

- 4G feature phone growth: The share of 4G feature phones in overall feature phone shipments increased to 10% in 2Q23, driven by the launch of JioBharat and itel Guru series. We believe this share will increase to 18% by the end of 2023. Rising demand for UPI, multiple launches by OEMs, and boost from Reliance will contribute to further growth of the segment.

- Inventory levels: The market ends Q2 2023 with eight weeks of inventory as Xiaomi and realme managed to clear most of their inventory through multiple sales and promotions.

- Other well-known brands with growth in Q2 2023 include Apple (+56% YoY), Transsion (+34% YoY), Lava (+53% YoY) and Nokia (+6% YoY).

03

Q2 Indonesia Smartphone Market:

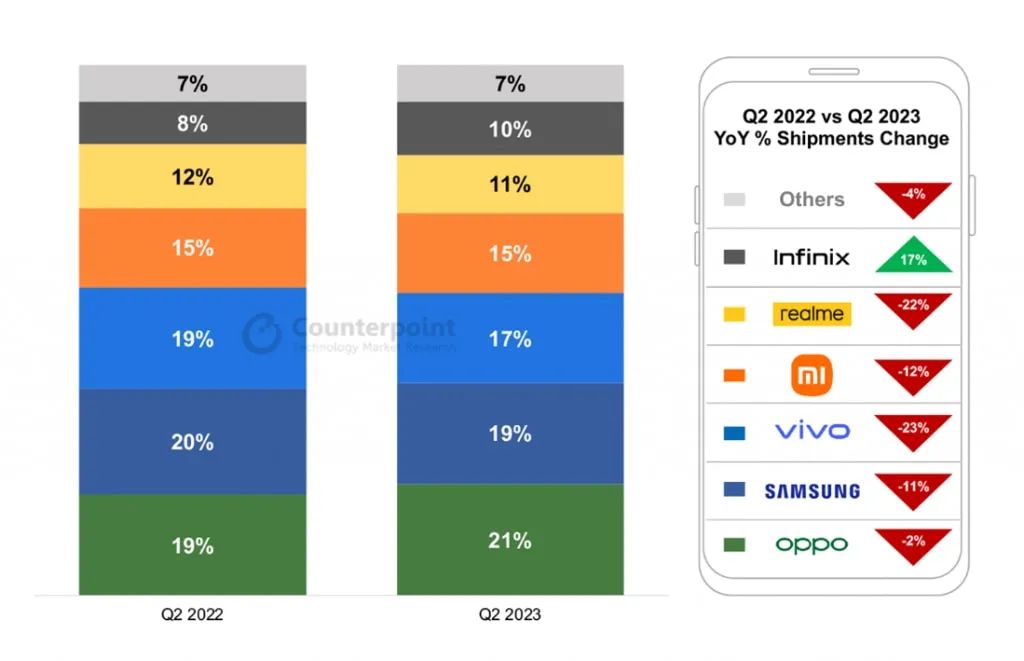

The characteristics of the Indonesian market are as follows:

- Smartphone shipments in Indonesia declined in Q2 2023 due to macroeconomic headwinds.

- OPPO surpassed Samsung with a 21% share and regained the top spot.

- With the exception of Infinix, all major OEMs experienced declines. Infinix's shipments grew 17% year-over-year.

- In the second quarter of 2023, the year-on-year decline in Xiaomi's shipments slowed to 12%.

- Shipments of 5G smartphones in the sub-$400 price segment grew 11% year-over-year.

2022Q2 and 2023Q2 Indonesia Smartphone Monthly Report, source, Counterpoint

2022Q2 and 2023Q2 Indonesia Smartphone Monthly Report, source, Counterpoint

In the second quarter of 2023, OPPO regained the first place in the market with a 21% share, mainly due to the support of its A17 series low-end models. The brand continued its aggressive marketing campaign, with models such as the Reno8 T series and Find N2 Flip released last quarter having a spillover effect on its market popularity. The Galaxy A04 series contributed significantly to Samsung's sales, limiting the brand's shipment share decline to just 1%.

Among the top OEMs, only Infinix's shipments increased by 17% year-on-year. The brand focuses on the sub-$200 price segment, offering better specs in its models. In addition, Infinix actively conducts marketing campaigns to increase brand awareness and popularity. Its newly launched products, such as the Note 30 series, Hot 30 series and Smart 7 series, contributed significantly to the brand's overall shipments.

Xiaomi’s shipment decline slowed sharply from 47% YoY in Q2 2022 to 12% in Q2 2023. The recent move shows that Xiaomi has been working hard to strengthen its supply and distribution. The OEM made strong marketing moves during the quarter, such as new product launches and adjustments to its discount program. The performance of the Xiaomi sub-brand Redmi was mainly due to its newly launched models, especially the Redmi A2 series and the Redmi Note 12 series.

Shipments of 5G smartphones in the sub-$400 price segment grew 11% year-over-year in the second quarter. Key OEMs in this segment include Samsung (with its Galaxy A14 5G, A23 5G, and A34 5G series) and Xiaomi (with its Redmi Note 12 series). The new iQOO Z7 5G series also joined this market segment.

Q2 Philippine Smartphone Market: Shipments Down 20% YoY

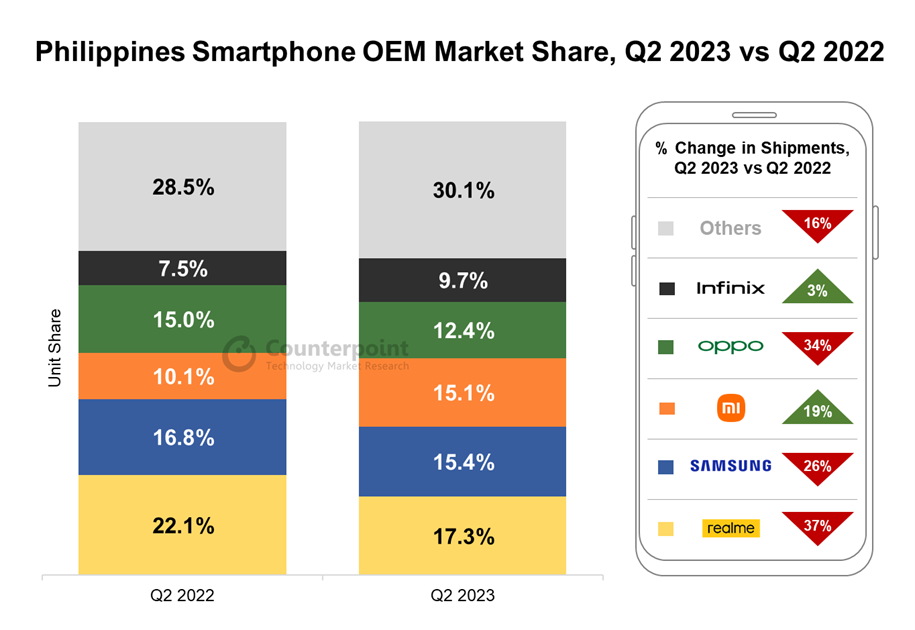

Also according to Counterpoint’s data, in the second quarter of 2023, smartphone shipments in the Philippines fell by 20% year-on-year in the second quarter of 2023 due to a combination of factors such as high consumption tax, rising production and distribution costs due to privatization of utilities, and weak peso. % .

The main characteristics of the Q2 Philippine market are as follows:

- Smartphone shipments in the Philippines fell 20% year-on-year due to continued sluggish demand due to factors such as high taxes and inflation.

- Xiaomi rose to third place on the back of the success of the Note 12 series and 19% year-on-year shipment growth.

- Back-to-back launches drove TECNO's year-over-year growth to 73%.

- High-end buyers shrugged off rising costs, driving the segment up 26% year-over-year.

- 5G smartphones under $200 grew 25% year-over-year.

Source: Counterpoint

Many major brands saw sharp declines this quarter. Although realme continued to maintain its position as the No.1 brand, its market share dropped to 17.3% due to a 37% year-on-year decline in shipments due to limited product launches and weak demand for smartphones. The brand was able to maintain the No. 1 position thanks to the popularity of its C55 model, which was also the best-selling model in the market in the second quarter of 2023, and the C53 model, which was snapped up overnight on Lazada. Samsung’s shipments in the second quarter of 2023 fell by 26% year-on-year, again due to fewer models launched and limited promotions in the budget segment.

In the second quarter of 2023, Xiaomi surpassed OPPO to rank third in the Philippines. Thanks to the good response of the Note 12 series, the brand grew by 19% year-on-year. Xiaomi also held its annual fan festival in April, offering promotions, especially for the newly launched Note 12 series and the popular 12C model, further fueling its growth.

Shipments of OPPO and vivo fell by 34% and 43%, respectively. Both brands are participating in the June payday sale, but the deals are more limited to older models to clear stock. Infinix recorded marginal growth of about 3%, but its market share increased to 9.7%, entering the top five brands in the quarter. Its budget Hot 30 series did well, while the Note 30 series got good reviews as a decent gaming phone.

TECNO performed well in the quarter, with shipments up 73% year-on-year, driven by a rapid and continuous model launch. The newly launched Spark Go and Spark 10 series performed particularly well due to their competitive pricing.

Shipments of smartphones priced below $200 and $200-$399 fell 22% and 16% year-over-year, respectively, as consumer spending was constrained. The $400-$599 segment saw an even bigger drop of 54%, as major brands such as Samsung and Realme launched fewer products.

However, the high-end segment (>$600) grew 26% year-over-year and was the only segment to show year-over-year growth. Apple still leads the field with a 43 percent share. The brand's official reseller, Powermac, has expanded its Apple Premium Partnership store offering an enhanced experience as well as offers and promotions for Apple customers. Other offers from the retailer revolve around 0% installment payments and iPhone bundle deals.

All price segments of 5G smartphones declined during the quarter, except for the sub-$200 segment, which grew 25% year-over-year due to the launch of Infinix Zero 5G and Note 30 and TECNO’s Spark 10 series 5G versions. Telcos are struggling to keep up with the likes of Globe Telecom, which recently rolled out 5G services at an additional 66 sites. However, the development of 5G infrastructure in the Philippines is still slow, mainly concentrated in urban areas such as Metro Manila, Cebu and Davao.

Despite the stagnant Q2 average selling price growth in the Indian market, the premiumization trend is likely to continue as emerging markets drive a new chapter of its growth, with mid-range brands targeting the premium segment and premium brands aiming to sell more premium models. As a result, global smartphone revenue and operating profit will start to recover from the second half of 2023.

Indonesia: Boost in second half

Counter expects Indonesia's continued macroeconomic recovery in the second half of 2023 to boost the smartphone market. Senior analyst Febriman Abdillah said: "Given the current macroeconomic environment, with commodity prices rising, price becomes even more important. Offering incentives to consumers such as discounts, bundled offers, bonuses and trade-in schemes can be a key factor in keeping the market attractive. an option for power. These incentives may even be relevant to the mid-range and high-end segments.”

At the brand level, Xiaomi's new move to cut prices this year may attract consumers and help the brand grow. As Infinix becomes more popular in the market, it may develop further.

Philippines: Demand likely to increase

Inflationary pressures in the Philippines have been declining, which has brought some relief to consumers. While we may see another quarter of year-over-year decline, demand may increase, especially with promotions in both online and offline channels. The premium segment is also expected to do well as Apple and Samsung launch high-end models in the next quarter.

05

Summary

Although the global smartphone market has experienced a relatively large decline, the three emerging markets in India and Southeast Asia have not experienced a large decline, and they show different characteristics, especially the high-end market is performing well, and the demand in the second half of 2023 is likely to increase , to boost confidence in the market.